Nonetheless it’s not likely borrowers with lousy credit rating scores can qualify for these loans. Most standard lenders require minimal scores in between 600 and 620. There may very well be a specialty lender or credit history union that could make an exception, but it’s not typical.

We've been an unbiased, marketing-supported comparison support. Our target is to assist you make smarter fiscal selections by offering you with interactive equipment and money calculators, publishing initial and goal content material, by enabling you to definitely carry out investigation and Assess data free of charge - so as to make money decisions with self-assurance.

Payday loans are shorter-phrase, small-dollar loans (usually as many as $five hundred) which you repay after you receive your future paycheck, generally two to 4 weeks after you get out the loan. Many lenders don’t require a credit history Check out, that is typically engaging for individuals with lousy credit history.

Evaluate your budget. Just before seeking the appropriate lender, Appraise your price range and understand how much loan you'll be able to pay for. If you're taking also significant of the loan out, you could possibly end up struggling to meet long term repayment obligations and detrimental your credit far more.

If a lender gives prequalification, you could begin to see the conditions you could be available without the need of affecting your credit score.

Common regular loan payments are depending on aggregate TransUnion credit score report data from Credit score Karma associates with Energetic personal loans as of December 2022

While curiosity fees on our list range click here between about 3% to 36%, it’s greater than most likely which the interest fee you receive will slide toward the top conclude of your vary with broken credit history.

Receive a Secured Bank card: Unsecured charge cards for lousy credit history are generally a foul offer, offering very little in the way in which of a loan at a significant Charge. And due to the fact a bank card is among the most accessible credit score-setting up Resource available to individuals, it’s finest to simply open up a secured credit card.

Forbes Advisor adheres to demanding editorial integrity criteria. To the best of our understanding, all material is exact as of your date posted, although gives contained herein might no longer be accessible.

This personal loan calculator will let you ascertain the regular monthly payments on the loan. To see your approximated month-to-month payments and full fascination you are going to pay, just enter the loan total, loan phrase and desire price during the fields under and click on compute.

Secured loans call for an asset as collateral though unsecured loans don't. Frequent examples of secured loans include things like home loans and vehicle loans, which help the lender to foreclose on your home inside the function of non-payment. In exchange, the charges and terms are generally far more competitive than for unsecured loans.

Loan-to-value ratio: Equally, your LTV is a measure of your respective loan quantity in relation to the amount the property is value. Lessen can also be superior for this metric, in the eyes of a lender.

Bankrate’s home equity calculator aids you establish exactly how much there's a chance you're able to borrow based on your credit history rating along with your LTV, or loan-to-worth ratio, that is the distinction between what your private home is worthy of and the amount of you owe on it.

The lenders frequently finance 90% of the worth with the . Some consumers may very well be eligible for 100% funding too. The down payment will be the difference between the on-highway price of the and the quantity funded by a lender.

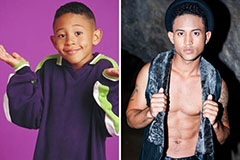

Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Shane West Then & Now!

Shane West Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!